Review Part Two: More On John Law

Millionaire: The Philanderer, Gambler, and Duelist Who Invented Modern Finance by Janet Gleeson (1999)

My delay in continuing a review of this title has come about because of a recent change in employment and the settling in process of new schedules, routines, and responsibilities. My willingness to challenge the extent of my employment opportunities here in Asia has been influenced not only by a fairly thorough understanding of investment risk, but also a desire to build competencies in the field of international business. It is natural then that by some fluke of timing, availability, and most importantly, relevant skills and qualifications, that I have been taken on at my latest employment as a full-time lecturer at the Department of International Trade and Management of Daejin University, located on the outskirts of Pocheon City in Kyonggido Province, about three-quarters of an hour distant from Uijeongbu which is currently the last subway stop on the purple line extending from central Seoul.

The new dynamics of the position include employers and supervisors with a great interest and passion in international business with an understanding of the core concepts of the training needs of their students. My main mission is to increase confidence among my students but in addition, to exercise managerial training in the teaching of English as a Second Language to international business students. You could say it is the job I have been actively searching for, for nearly two years.

My attachement to working in the Korean Penninsula is noted, not only by my voluntary return but also in the surprising confirmation that my skills and training are actually specifically valued here, even if during my search for this job I may have doubted that at times. As I fully support the principles of self-actualisation in the achievement of personal goals, be they business or pleasure, I believe I have succeeded in attempting to encourage continual development in my own competencies out of a nourishing desire to follow my dreams and particularly an interest in profiting from the research abilities that learning about international business has added to my curiousity, wonder, and pleasure in approaching diverse topics, views, and cultural realities.

So the topic of John Law beginning from the early 1700's as presented by Janet Gleeson is a wonderful example of the early exploits of a daring risk-taker of his times. Through her research, Gleeson has opened not only an understanding of the human conditional relativism which comes and goes in global approaches to valuable knowledge in the areas of history, particulary that of business, but also the revelatory aspects of returning vital information to an age of information-driven relevancies which often miss the point of knowledge through a communalist rush to technologically change or alter its value. The more I read of diverse topics, in particular through well defined examples, such as the story of John Law relates, the more I am convinced that too easily mass media culture defines for individuals the relevancy of information, and that culture itself, through immeasurable changes, is less and less defined by individuals through altruistic or humanist essentials. None profits more from such paradigm shifts than global businesses themselves.

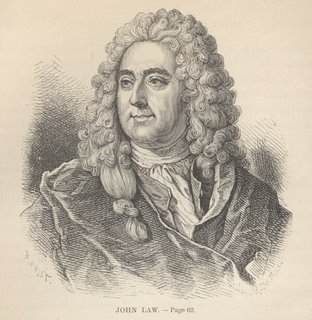

John Law as an integral character in the course of human studies of macro-economics theory and practice has often been overlooked in contemporary appreciation of the trail of economic development, from mercantile to global ages, simply because the leaders of such market-driven changes would prefer to distance themselves from the purity of his perceived strengths, notably gambling and perceived vices. What John Law was, what John Law did was extraordinary, and the establishment would rather attempt to increase the historical relevancy of Hume, Smith, or Keynes, typical fusty academes, and disassociate the historical speculative interests of robber-barons and their continued role in modern commodities, shares, and currencies exchanges.

John Law was a Scotsman and a peripheral figure in English affairs, however an excellent gamings tables winner, a man knowable and known among the aristocratic gamblers of his day. The people he influenced not only had money to make but easily also carried crowns and crown jewels to sell and much money to lose. Debts and losses may be a perpetual pleasure of the rich, as long as their creditors are satisfied to earn based on interests payments alone. One might say that is the ultimate keystone of bonds and debt interest earnings in the USA today. So Law as a gambler not only accumulated earnings but also liabilities. In his case, he was able to balance the two and make a name for himself as an economic philosopher at the same time. For a time.

In many nations of Europe during his time, their existed the desire to exploit the resources of the New World. Yet to do so required capital which even the richest financers might not always possess. In particular the monarchs and kings needed to maximize the return on their tax earning incomes, through the manipulation of capital flows and the comparative pricing which fuels international trade. However monetary policy, as previously mentioned was a weakest link in the system. Currency in precious metals could not be equitably valued within nations or across them. Such that the content of gold or silver in crowns, florins, ducats, or sous might easily fluctuate from one European trading capital to another, so that the smuggling of currencies from one place to another to extract higher comparative returns from it was common practice.

John Law was the first visionary to adequately address the issue, which was essential to the maintenance of governments in monarchies where the competitive edges depended upon development of new resources in the New World. This required agglomerations of capital never before witnessed to build shipping empires, trade centres, New World commodities production and distribution. His concept was simple and fairly taken for granted today. One must create central banks which issue paper currencies based upon the precious metals of the day, guaranteeing values for exchange to establish and maintain control of the value of products and services and extract their profits, namely in the ability to speculate and trade shares instead of goods, to finance bonds and loans for the development of new industries, technologies, and companies.

That this man was a foreigner in France when he was taken on through his connections to royalty to manage a national bank was a first. France was in a unique position of being for many centuries a highly developed nation in the extraction of maximum taxation from its population for minimum concessions in the areas of political, social, or economic reforms. However his reforms extended to tax services and government employment, long a method by which the elites could manipulate and profit from inefficencies which partially distributed the taxable incomes gathered through taxation service agencies and bled the governmental income through nepotisitic hiring practices.

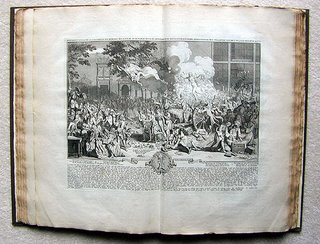

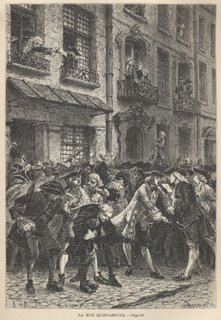

His issuances of shares in the Louisiana Company highly developed the redistribution of assets through the upper middle classes but was such an effective pyramid scheme that the basics of its operation were also international in nature, drawing the essential investment incomes of Europeans generally and the British in particular, raising their own similarly funded schemes in development of The East India Company. Shares trading in France became a national and continental obsession as one might say it has become today in many nations. Mostly due to the noted rises in earnings profits and the measures of limitless possible gain or capital growth.

While Law maintained the speculative incomes the bank and its issues of paper currencies were successful. As confidence in the enterprise diminished, particularly through the realisation that The Louisiana Company was over-estimating its assets in the New World, coupled to instances of bubonic plague, trade cessations, and investment flight, various economic dynamics broke down. The demands for precious metals by industries in terms of payment and the investor's desire to redeem their shares for metals reduced the bank's confidence, which forced it to negatively revalue several times in attempts to purge its eventual collapse in paper currency eventually leading to stock collapse and the type of crises witnessed in 1997 in Asia or Russia, or seemingly ongoing in Turkey or Argentina.

The net effects were that Law became reviled, his notarious flight giving real insight into the terms "splinter groups" according to the treatments of roving crowds and the fate of carrriages though to contain him. His bank's owners profited enormously through the effective bankruptcy of a majority of their net credtiors, diminishing not only their holdings in earnings, but also their debt responsibilites while Law became an international scapegoat and eventually died liquidity poor in 1729 in exile in Venice.

However Gleeson's dynamic portraits of Law effectively draw the dualistic nature of his temperment, ethics, and true actions. He is defined as a fairly benevolent character, flawed, as was his system, but visionary. Even nearing his demise he wa one of the first to realize the potential investment values of artwork and in particular the investment value of fine paintings.

Furthermore, Gleeson paints him as the pioneer that he was, and gives him the econometrical credit that he deserved then, and now. His experiment was simply decades ahead, perhaps a century ahead of its time. Few early economists can claim such an experiment as their own.

The story of Law proves that a foreigners often do make their fortunes far from home.

A good risk worth taking in an increasingly globalized, however continually risk-averse world.

Gleeson has detailed the relevancy of reading her book simply through an extremely well developed tale-telling ability and a skill in arranging the record as it should be told. Her balanced story is not only excellent it is perpetually relevant.

No comments:

Post a Comment